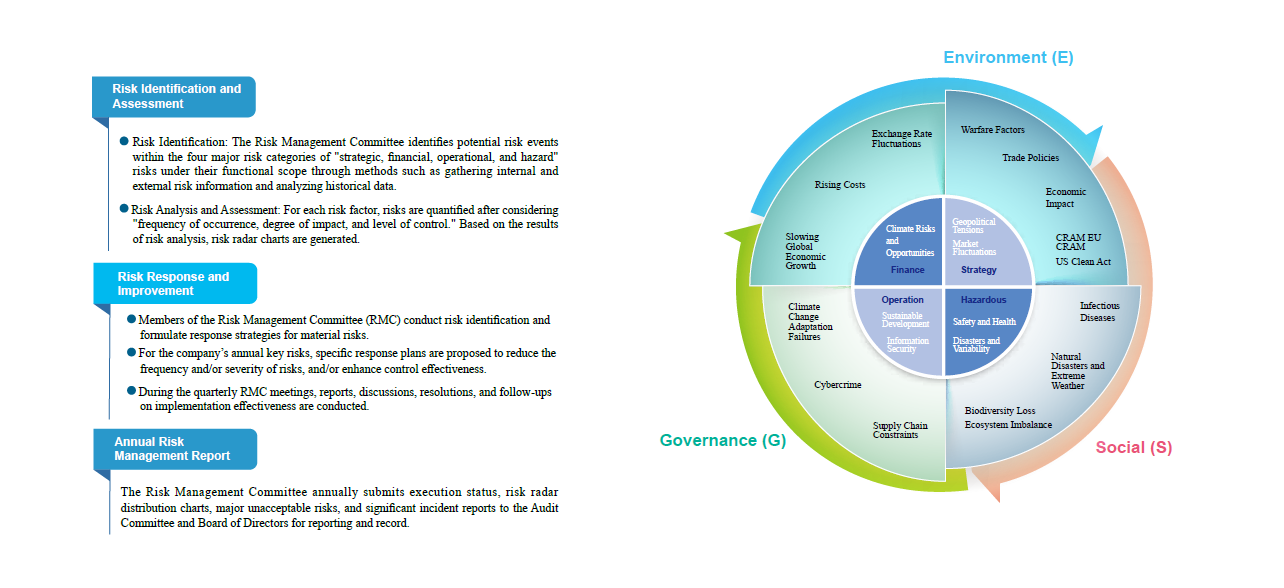

The company conducts risk management based on the three risk management cycle steps. The relevant steps are explained as follows:

Step 1 Risk Prediction Management:

Predictive risk management refers to the identification and assessment of potential risks that may impact a project or organization. The process includes:

(1) Risk identification: Identify possible risk events through internal and external risk information collection, historical data analysis and other methods.

(2) Risk analysis: Use qualitative and quantitative analysis methods to evaluate the possibility and impact of risks, and determine the significance of risks with a risk matrix.

(3) Risk assessment: Based on the results of the risk analysis, the risks are ranked and the priority order of risk attention is determined.

Step 2 Risk monitoring and management:

Monitoring management involves regularly tracking risks and the effectiveness of related controls. include:

(1) Set goals: Determine key risks and key goals to monitor risks and the achievement of control measures.

(2) Monitoring system: Establish a monitoring system for review and reporting to regularly assess risk status.

(3) Audit evaluation: Conduct regular internal or external audits to ensure that risk management measures are effectively implemented.

Step 3 Risk response management:

Response management refers to the development and execution of response strategies to identified risks. include:

(1) Response and improvement prevention: For important risks, develop risk mitigation, transfer, acceptance or avoidance strategies.

(2) Strategy execution: Integrate risk response strategies into project plans or organizational processes, and assign responsible persons.

(3) Emergency preparedness: Develop BCP plan drills for possible risk events in order to respond quickly when risks occur.